Additional Director Appointment under Companies Act, 2013

Article discusses Procedure for the appointment of Additional director, Procedure of Regularisation of Additional Director as Normal director and ROC Forms required to be filed for Additional director.

Relevant Sections: [161(1), read with 152, 153, Schedule I Table F Regulation 66 AOA of Companies Act, 2013]

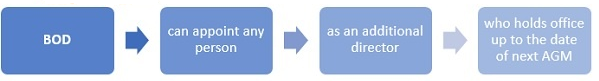

Generally, every director shall be appointed by the members in General Meeting of the Company, but appointment of an Additional Director is an exception to this, accordingly:

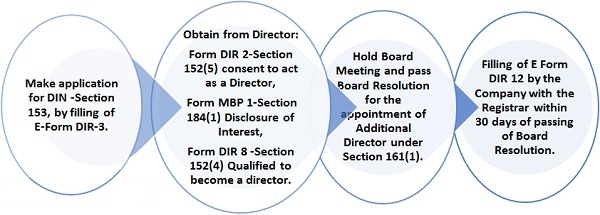

Procedure for the appointment of Additional director:

Procedure of Regularisation of Additional Director as Normal director:

- Hold Board Meeting for calling AGM.

- Dispatch Explanatory Statement along with Notice of AGM to the members.

- Hold General Meeting and pass Ordinary Resolution for the appointment as Director.

- Filling of E Form DIR 12 with the registrar for the intimation of Change in Designation i.e. from Additional director to Director of the Company.

- Maximum No. of Additional Directors: Max. no. as fixed by AOA.

- Power to appoint: shall authorize under Articles of Association (AOA)

- Powers of Additional Director: Same as of Normal Director

- Vacation of Office: Shall vacate office up to the date of next AGM.

Forms:

1. E Form DIR 3: Application for allotment of DIN

2. DIR 2: Consent to act as a Director

3. DIR 8: Not Disqualified to be appointed as a director.

4. MBP 1: Disclosure of Interest

5. E Form DIR 12: Particulars of appointment of Directors and changes among them.