All about Section 185 of Companies Act, 2013

Section 185 explains Provisions under Company Law Related to Direct or Indirect Loan or Advances to Directors by Company. Loan or advances include loan represented by a book debt, to any of the directors or to any other person in whom the director is interested or give any guarantee or provide any security in connection with any loan taken by him or such other person. Article also explains filing requirement related to Loan or Advances to Directors and penalty for contravention of Provisions of Section 185 of Companies Act, 2013.

| Loan given by Company to below mentioned persons | Allowabilitiy |

| To Its Directors | x |

| To Relative of Directors | x |

| To the Directors of its Holding Company | x |

| To the partner of the firm in which Director is a Partner | x |

| To the Partnership Firm in which its director or its Holding Company is a Partner | x |

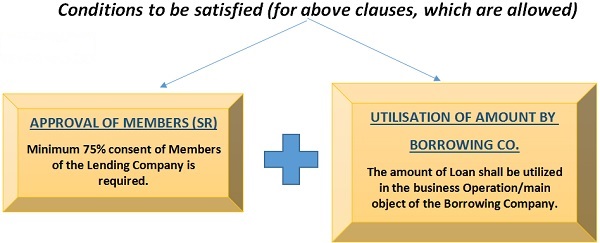

| To any Private Company having common directors or members | √ |

| To any Body Corporate in which director, or by two or more such directors, together, exercise 25% of the total voting power at a General Meeting of the Borrowing Company | √ |

| Any Body Corporate, in which the Board of directors is accustomed to act on the directions or instructions of the Board of Lending Company | √ |

Filling Requirement:

Upon passing of Special resolution by the members of the Company, the Company shall file form MGT 14 within 30 days of passing of Special Resolution to intimate the same to concerned ROC

Cases where Special Resolution is not required by the Company even when the above said limits exceeded:

Loan to Managing Director or Whole Time Director:

As a condition for the services extended by the company to all its employees Under Employee Stock Option Plan

The Lending Company’s ordinary course of business is lending or providing Loans and the rate of interest chargeable should be more than the prevailing yield of Government Security closest to the period of the loan.

The Loan or guarantee provided to its wholly owned subsidiary Company.

The guarantee provided to its subsidiary Company in respect of loan taken from any Bank/Financial Institution.

Penalty for Contravention under Section 185

If a company contravenes any of the provisions of this section, the punishment would be as follows:

For Company:

Fine – Minimum Rs. 5 Lakhs and

Maximum Rs. 25 Lakhs.

For officers in default:

Imprisonment – Maximum 6 months; and/or

Fine – Minimum Rs. 5 Lakhs and

Maximum Rs. 25 Lakhs