Comparison between Branch office & Subsidiary company

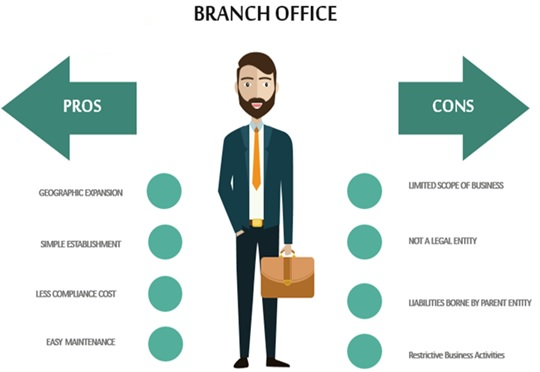

Meaning of Branch Office: Branch office implies an establishment set up by parent company to perform the similar business operations at different locations. One of the common strategies of the Companies to expand their business at the national or international level, is to set up branches, at different places. Branches are a part of the parent organization, which are opened to perform the same business operations as performed by the parent company to increase their reach.

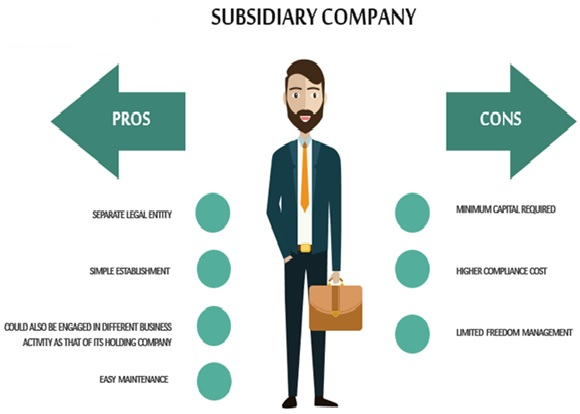

Meaning of Subsidiary Company: Subsidiary Company is understood as the company whose fully or partially controlling interest is held by another Company.

| Point of Difference | Branch Office | Subsidiary Company |

| Approving Authority | Reserve Bank of India and Ministry of Corporate Affairs | Ministry of Corporate Affairs |

| Registration Requirements | Net Worth of Foreign company must be above $100000The Foreign Head Office shall have a profitable track record of 5 years | Minimum No. of Directors: 2 in case of Private and 3 in case of Public;Minimum No. of shareholders: 2 in case of Private and 7 in case of Public;

Registered Office: The Registered office shall be situated within India in any State; Name: The name of the Subsidiary Company may or may not be same as of its Holding Company. |

| Registration in India | Companies incorporated outside India engaged in different activities can setup a BO in India with specific approval of Reserve Bank of India (RBI). |

|

| Liabilities | Liabilities extend to Parent Organization. | Liabilities limited to Subsidiary Company. |

| Reports to | Head office | Holding Company or Shareholders |

| Business Activities | Branch conducts the same business as of parent organization | Subsidiary may or may not conduct same business as parent organization |

| Separate Legal Entity | Yes, as far as MCA filings and Taxation are concerned. | Yes |

| Ownership | The parent organization has 100% ownership interest in the branch | The parent organization has more than 50% ownership interest in the subsidiary |

| Whether invoicing from India allowed ? | Yes | Yes |

| Renewal of registration required? | Generally, no but in some cases RBI gives approval for 2-3 years. | No |

| Exchange Control |

|

|

| Whether expatriates allowed to work on payrolls of rolls of Indian entity? | Yes | Yes |

| Can any number of projects be executed? | Yes | Yes |

| Prior Approval from Reserve Bank of India | Yes | No |

| Payment of Dividend to its shareholders | No | Yes |

| Submission of Annual Certificate with RBI | Yes | No |

| Conducting Board Meeting and Members Meeting on yearly basis | No | Yes |

| Annual Compliances with ROC and Income Tax | Yes | Yes |

–