Procedure for Import Export Code (IEC) Registration

An IEC is necessary for Import or Export of goods. The first requirement before you start an Import or Export business in India is to obtain an IEC. IEC Code is unique 10 Digit code issued by DGFT – Director General of Foreign Trade, Ministry of Commerce, Government of India.

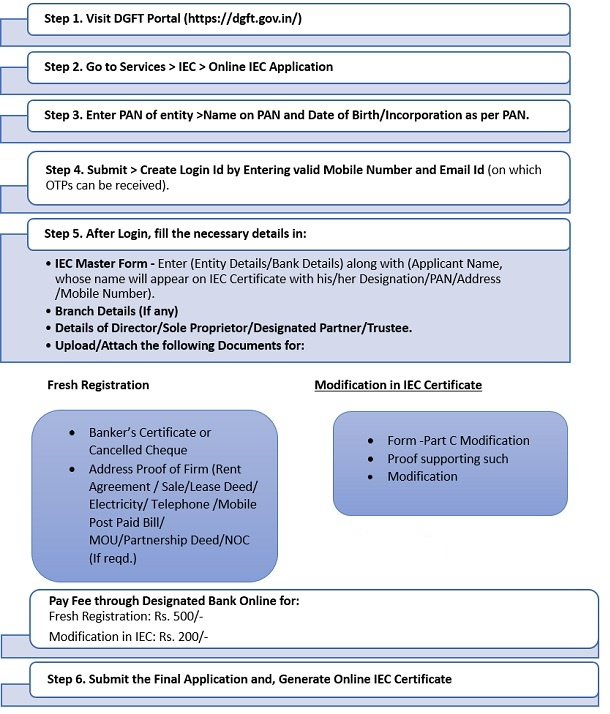

The PAN based IEC Registration Certificate generated online (on STP mode), by following the beneath six steps:

BENEFITS OF IEC REGISTRATION:

1. It is the primary proof for a firm as an Importer/ Exporter in India.

2. It is submitted to obtain various benefits in respect of export and import from customs, DGFT, Export Promotion Council etc.

3. It acts as a license for Importing and Exporting of goods.

4. Through IEC number, Goods are cleared from the custom authorities easily.

5. IEC reduces the transport of illegal export.

6. IEC not required for personal use.

7. No Annual Renewal Fee.

8. No Annual/Quarterly Compliance after obtaining registration.