Conversion of Loan into Equity share Capital of the Company

Certain advantages for conversion of loan into equity share capital of the Company:

- No cash exchange occurs in the debt-to-equity swap.

- Increasing cash flow by decreasing liabilities.

- Avoidance to paucity of financial resources.

Process chart for Conversion of Loan into Equity shares

Section 62 (3) of Companies Act, 2013

Phase 1:

Important Note: It is mandatory to pass the special resolution at the time of acceptance of Loan with the term of conversion into equity share capital in future.

Phase 2:

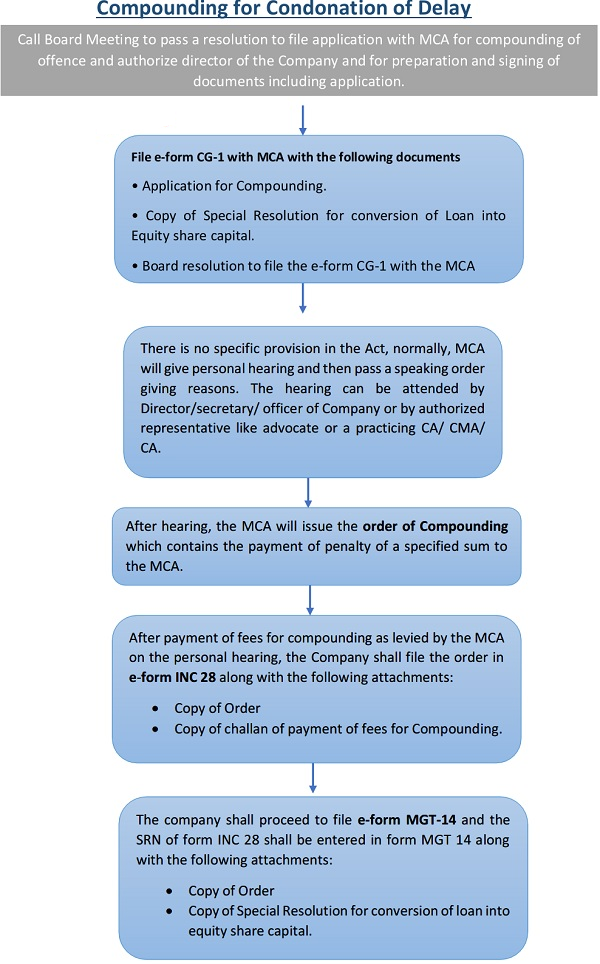

Implications for non-filling of e-form MGT 14 within 300 days from the date of passing of Special Resolution:

What can be the amount of Penalty which MCA can levy?

The amount of maximum twenty-five lakh rupees can be levied on the Company. The penalty of maximum Five Lakh rupees can be levied on each director and other officers of the Company.