How to file Income Tax return when window to file the tax return is closed by Income Tax portal

How to file Income Tax return when window to file the tax return is closed by Income Tax portal.

How to file Income Tax return when window to file tax return is closed

31st March, 2021 has gone and the assessee who have failed to file their respective ITR for AY 2020-21 tend to lose their claim of income tax refund what they are eligible for. Section 139 of Income Tax Act allow the assessee to file its ITR on or before the specified due date which is 31st October or 31st July of relevant Assessment year as the case may be. However, assessee can file a belated return also before the end of the relevant assessment year, however beyond that ITR cannot be filed. Most of the people miss this deadline. The reason in most of the cases is that the individual assessee generally is not aware of it . It actually happens largely in NRIs cases where they have income taxable in India and TDS has also been deducted but have failed to file ITR. It results in loss of TDS refund which could have been claimed by filing the ITR.

However, there is another option to file ITR even if the last date of filing has been missed. Section 119 (2)(b) provides that CBDT can authorize income tax authority to admit an application or claim of any refund after the expiry of period specified by the Act. To operationalize this provision, CBDT issued a circular (No. 9/2015) dated 09.06.2015 vide F.No. 312/22/2015 which contains the comprehensive guidelines on the conditions for condonation and the procedure to be followed for deciding such matters.

For those who find difficulties in filing delayed return and whose TDS refund has been stuck due to anomalies of the law, below mentioned is the detailed procedure which can be followed for filing delayed ITR

Stepwise procedure

Step-1: File a manual application to the jurisdictional chief commissioner/principal chief commissioner of the income tax. You can check your jurisdiction in ‘My Profile’ under the tab ‘PAN details’. The application shall be properly addressed to the commissioner and shall contain all the material fact. There must be a valid reason for non-filing the ITR within the due date along with supporting documents. Also, attach a draft computation and mention the amount of refund along with supporting e.g. Form 26AS or Form 16/16A or tax payment challan etc.

Step-2: After submitting an application as above, the jurisdictional commissioner or chief commissioner as the case may be, shall ask for the information regarding your claim. A notice will be issued by the department which can be accessed through ‘e-proceeding portal’ and a reply to the notice may also be submitted online.

Step-3: After due verification of all the information provided by the assessee, the commissioner or principal commissioner as the case may be, shall decide upon merit in accordance with law and shall pass an order under section 119(2)(b). The order will be available under ‘e-proceeding’ tab only and shall also be emailed on the registered email id of the assessee.

Step-4: After receiving such order, assessee may proceed with filling return as depicted in following images.

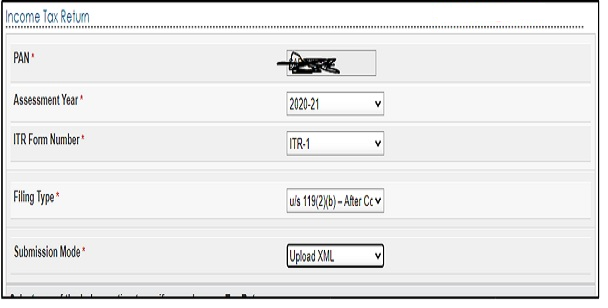

Select assessment year and ITR Form and under filing type select ‘u/s 119(2)(b). Thereafter, below screen will appear,

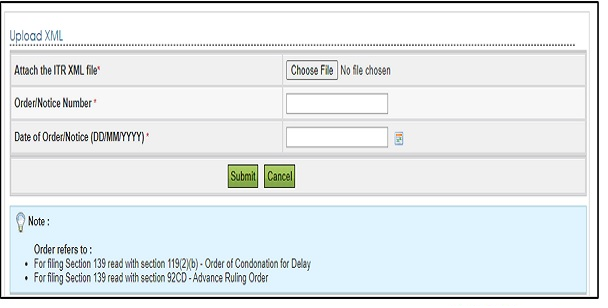

Attach the ITR XML and mention the order number and date of order and submit. The ITR will be filed. The ITR shall thereafter will be processed normally as if the return is filed u/s 139.

Following further points shall also be applicable under section 119(2)(b),

- If the amount of refund claim is less than Rs. 10 lakhs then Principal Commissioner/Commissioner shall be vested with the power of acceptance or rejection of application filed u/s 119(2)(b)

- If the refund claimed is more than Rs. 10 lakhs but less than Rs. 50 lakhs then Principal Chief Commissioner/Chief Commissioner shall have the power to accept or reject the application filed u/s 119(2)(b)

- If the refund claimed is more than Rs. 50 lakhs, then CBDT shall consider such application.

- The application cannot be filed after six years from the end of the assessment year for which such application is made. The application shall be disposed by the competent authority within 6 months as far as possible.

- An application may also be filed for additional amount of refund after completion of assessment for the same, provided all the conditions are fulfilled subject to following further conditions,

- The income of the assessee is not assessable in the hands of other person

- Interest shall not be given on such refund

- The refund should be arisen due to excess TDS/TCS or excess advance tax or access self-assessment tax