All about Inter-Corporate Loans and Investments made by Company

ALL ABOUT INTER-CORPORATE LOANS AND INVESTMENTS MADE BY THE COMPANY UNDER COMPANIES ACT, 2013

COMPANY

> Gives Loan to any person

> Investment in Body Corporate

> Provides Security to any person

> Provides Guarantee to any person

–

Important Note: – The word “person” does not include any individual who is in the employment of the company

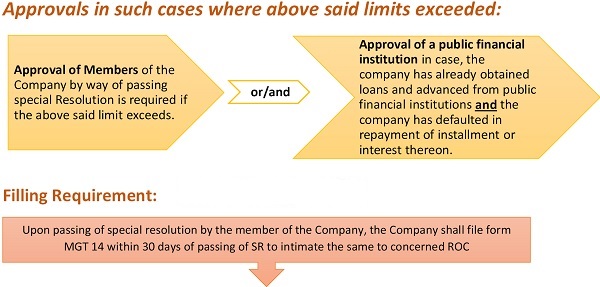

Cases where Special Resolution is not required by the Company even when the above said limits exceeded:

> Where a loan or guarantee is given or where a security has been provided by a company to its wholly owned subsidiary company or a joint venture company, or purchase or subscription of securities of wholly owned subsidiary company by its holding company.

Few Important point to keep in mind while giving Loans, providing securities or making Investment:

> The rate of interest chargeable should be more than the prevailing yield of Government Security closest to the period of the loan.

> The company which is in default in the repayment of any deposits accepted before or after the commencement of this Act or in payment of interest thereon, shall not give any loan or give any guarantee or provide any security or make an acquisition till such default is subsisting.

> Every company giving loan or giving a guarantee or providing security or making an acquisition under this section shall keep a register in Form MBP 2 at the registered office of the company.

Non-Applicability of Section 186 of the Companies Act, 2013

1. Loan Made, guarantee given or security provided or investment made by:

- Banking Company, or

- Insurance Company or

- Housing Finance Company

- in the ordinary course of its business or whose principal business is of lending of money to the general public.

2. To any Investment:

- made by an investment company;

- made in shares allotted by way of rights issues made by a body corporate;

- Investment made by an NBFC company whose main business is to invest in the securities of the Company.

“Investment company” means a company whose principal business is the acquisition of shares, debentures or other securities.

Penalty for Contravention of Section 186

> If a company contravenes any of the provisions of this section, the punishment would be as follows: