Can a foreign national start a business in India without being a resident?

A Foreign National can start a business in India without being a Resident and one can setup up a new business in India in any of the following ways:

A. Limited Company (Private Limited/Public Limited Company)

B. Limited Liability Partnership (LLP)

C. Branch Office or Liaison/Representative Office, Project Office

A. LIMITED COMPANY

A non-resident Indians can incorporate a Company in India under the Companies Act, 2013, as a Private Limited, a Public Limited or a Wholly Owned Subsidiary (WOS).

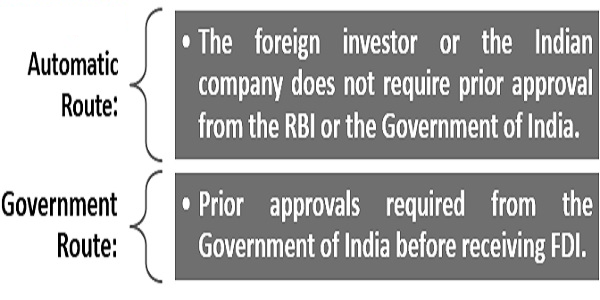

Foreign Direct Investment (FDI) is freely permitted in Limited Companies subject to the FDI Policy in almost all sectors. Under the FDI Scheme, non-residents can make investments in shares/convertible debentures/preference shares issued by an Indian company through two routes:

B. LIMITED LIABILITY PARTNERSHIP (LLP)

An LLP is an incorporated under Limited Liability Partnership Act, 2008. It is that form of business which combines the features of partnership and the company both.

Foreign Direct Investment (FDI) is freely permitted in Limited Liability Partnership subject to the FDI Policy in almost all sectors like Limited Companies.

C. BRANCH OFFICE / LIAISON OFFICE /PROJECT OFFICE

Business entities registered outside India (“Foreign Company”) can establish business operations in India without creating and registering a limited company or limited liability partnership.

Subject to the RBI guidelines, a foreign company can open a Branch Office or Liaison Office or Project Office in India. The scope of operations of such offices is typically limited to projects or activities and functions such as country representative office, sourcing, technical and/or marketing support, import and export, etc.

Documentation

The documentation process will depend upon the chosen Business type. Generally, any document executed outside India or a copy of document produced from outside India must be notarized and apostilled or attested by the Indian Embassy in their respective countries as per Hague Convention guidelines.

Application to respective Authorities for registration in India

In case of Limited Companies and Limited Liability partnerships, application is required to be filed with the Registrar of Companies (“ROC”), Ministry of Corporate Affairs.

In case of Branch office / Liaison Office/ project office the application is required to be filed with the Reserve Bank of India and after obtaining the approval from the RBI, the entity is required to be registered with Registrar of Companies (“ROC”), Ministry of Corporate Affairs.

General Information/ Documents Required for Foreign National:

1. Directors’ Identification Number, if already obtained from Registrar of Companies in India

2. Copy of valid Passport

3. Copy of Address Proof such as Telephone Bill / Mobile Bill/Electricity Bill / Bank Account Statement must be in the name of foreign national and should not be older than 2 months.

4. Valid Mobile Number

5. Valid Email ID

Obtain the Registration and proceed to Business Start-up Formalities

After obtaining the Business entity registration, the business can proceed to open bank account and to appoint people and start its business operations. Also, the business is required to obtain other required registrations such as Goods and Service Tax Registration (GST), Professional Tax and Shops and Establishment Registration etc.