Compliance Chart for Preferential allotment of shares

Points to remember

Issue should be authorized by Articles of Association of the Company.

Only fully paid securities to be issued and the following securities can be issue under preferential allotment.

Issuance of Equity shares.

Issuance of Fully or partly convertible debentures

Issuance of any other securities convertible into equity shares.

The preferential issue can be offered to person other than equity shareholders of the Company and prepare a list of persons (not exceeding 200 in a financial year for each kind of security) to whom offer may be made. (While counting 200, QIB and ESOP are excluded).

Ensure that no allotment is made against any previous offer/ invitation of any kind of security is pending.

Prepare a list of persons (not exceeding 200 in a financial year for each kind of security) to whom offer may be made. (While counting 200, QIB & ESOP are excluded)

Determination of Issue Price on the basis of valuation Report of Registered Valuer.

Where convertible securities are offered, price of resultant shares shall be Determination of Issue Price on the basis of valuation Report of Registered Valuer determined before and on basis of valuation Report.

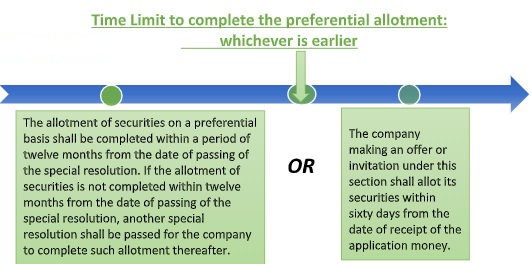

Time Limit to complete the preferential allotment:

whichever is earlier

–

Important Note: Right to acquire Shares under Preferential allotment can’t be renounce in favor of any other person. Meaning thereby, no person other than the person so addressed in the application form shall be allowed to apply through such application form.