Related Party – AS 18 vs Transfer Pricing

AS 18 defines the disclosure requirements related to related party relationship and transaction between a reporting enterprise and its related parties in the financial statement of that enterprise. The basic assessment during disclosure is centered upon two things viz., who is related party and what amounts to related party transaction. As per AS 18, following is the definition of related party.

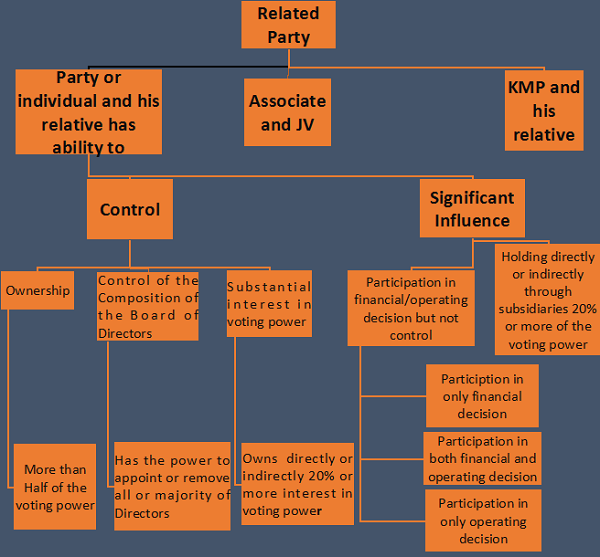

1. Related Party: – Parties are considered to be related if at any time during the reporting period one party has the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions. For better understanding, a related party tree is graphically presented as below:

Related Party-Graphical Representation

2. Related Party Transaction: – Related Party Transactionmeans a transfer of resources or obligations between related parties, regardless of whether or not a price is charged.

3. Disclosure Requirement

| Particulars | Control exists between the related parties | Control does not exists between the related parties |

| There have been transactions between the related parties during the period | Name of the party and relationship to be disclosed and transactions are to be disclosed | Name of the party and transactions are to be disclosed. Relationship not to be disclosed. |

| There were no transactions between the related parties during the period | Only name of the party and relationship to be disclosed | No disclosure is required. |

What needs to be disclosed when disclosure required as above.

(i) The name of the transacting related party

(ii) Description of the relationship between the parties

(iii) Description of the nature of transactions

(iv) Volume of the transactions

(v) Any other information for better understanding

(vi) Outstanding amounts of related parties

Followings are the related party transaction in respect of which disclosure would be required in financial statement of reporting entity.

(i) Purchase or sales of Goods or services

(ii) Purchases or sales of goods (finished or unfinished);

(iii) Purchases or sales of fixed assets;

(iv) Rendering or receiving of services;

(v) Agency arrangements;

(vi) Leasing or hire purchase arrangements;

(vii) Transfer of research and development;

(viii) License agreements;

(ix) Finance (including loans and equity contributions in cash or in kind);

(x) Guarantees and collaterals; and

(xi) Management contracts including for deputation of employees.

Disclosure as per Transfer Pricing Provisions

As per Chapter X of Income Tax Act, any international transaction entered into with Associated Enterprise and any specified domestic transaction mentioned as per section 92BA, shall be computed as per arm length price and the same shall be reported in Form 3CEB.

Therefore, two types of transaction viz., international transaction entered into with Associated Enterprises and Specified Domestic Transaction as per section 92BA shall be reported in Form 3CEB. In this context, it is worth understanding the Associated Enterprises.

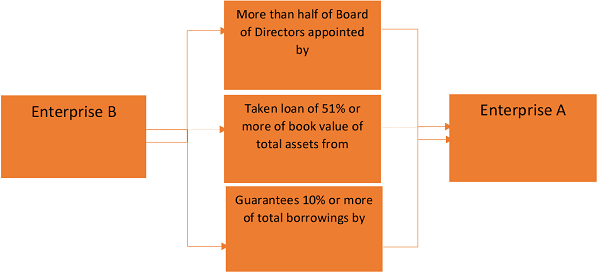

Associated Enterprises- A graphical representation

Case 1: Financial Control

*Enterprise A, B and C are AE

Case 2: Operating Control

*Enterprise A and B are AE

Case 3: Common Control

*Enterprise B and C are AE

Specified Domestic Transaction as per Section 92BA

1. Any transaction related to Chapter VI-A of Income Tax Act i.e. deduction under section 80C to 80U

2. Any business transacted between the assessee and the person specified in Section 80IA or Section 10AA.

A comparative analysis of AS 18 and TP provisions

| Condition | As per AS 18 | As per TP |

| One party having more than 50% shares of other party | Related Party | Associated Enterprise |

| One party has the power to appoint all or more than half of board of director | Related Party | Associated Enterprise |

| One party, directly or indirectly, having 20% or more but less than 26% shares of other party | Related Party | Not Associated Enterprise |

| One party, directly or indirectly, having 26% or more shares of other party | Related Party | Associated Enterprise |

| One party participate in operational and financial decision of other party | Related Party | Not Associated Enterprise |

| One party advanced loan of 51% or more of total borrowing of other party | Not Related Party | Associated Enterprise |

| One party guarantees 10% or more of the total borrowing of other party | Not Related Party | Associated Enterprise |

| The manufacturing or process of one enterprise is dependent on know-how etc. of the other party | Not Related Party | Associated Enterprise |

| One party supply 90% or more raw material to other party | Not Related Party | Associated Enterprise |