Significant Beneficial Ownership Rules (SBO Rules) dated 8th February, 2019

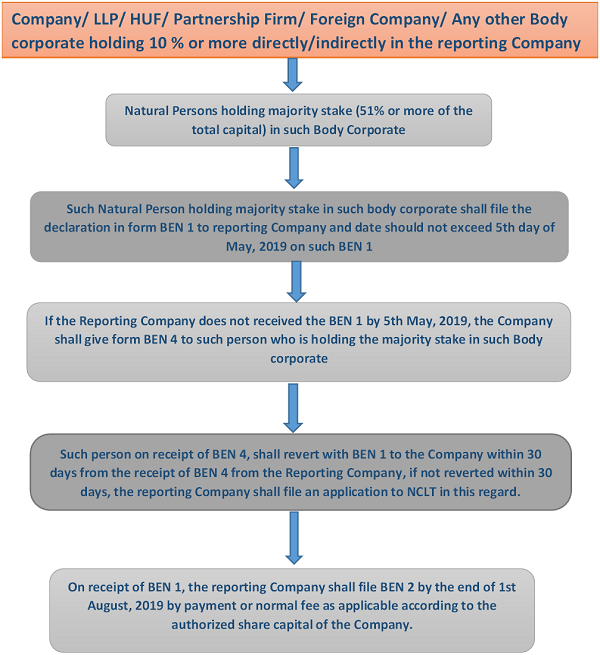

Every significant beneficial owner shall file a declaration in Form No. BEN-I to the company in which he holds the significant beneficial ownership within thirty days in case of any change in his significant beneficial ownership.

‘significant beneficial owner‘ in relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:-

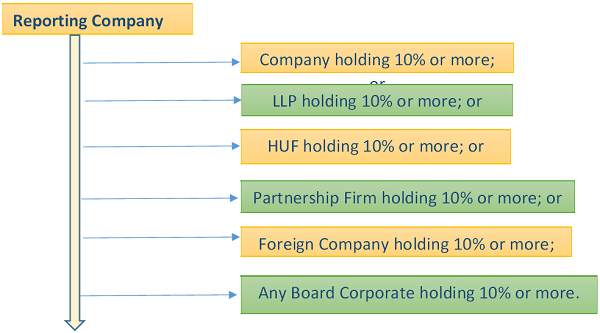

If any of the above is holding 10% or more in the Indian Company, then SBO Rules shall apply to such company.

Disclosure under Section 90 in regard to significant Beneficial Ownership: