MAJOR AMENDMENT IN COMPANIES ACT,2013 FOR PRIVATE COMPANIES

Analysis of Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 ( Briefly explained in laymen terms)

After the Amendment in Companies (Prospectus and Allotment of Securities) Rules, 2014, a new Rule 9B has been inserted to bring Private Limited companies within the ambit of dematerialization. (Dematerialization of shares in India)

- All Private Limited companies excluding “SMALL COMPANIES” have to mandatorily obtain ISIN and convert the securities into demat form before 30th September 2024.

- No such company will be able to make any offer for issue of any securities or buyback of securities or issue of bonus shares or rights offer without converting the securities of its promoters, directors and KMPs in Demat form.

- Similarly, every security holder is mandatorily required to convert his securities into Demat Form before he intends to transfer such securities.

- Further, every security holder first needs to convert his existing securities into demat form before subscribing any securities of such company.

GET IN TOUCH WITH US

Always ready to help you out regarding all your queries.

Brief Layout:

- “9B. Issue of securities in dematerialized form by private companies) Every private company, other than a small company, shall within the period referred to in sub-rule (2) (a) issue the securities only in dematerialized form; and

- A private company, which as on last day of a financial year, ending on or after 31st March, 2023, is not a small company as per audited financial statements for such financial year, shall, within eighteen months of closure of such financial year, comply with the provisions of this rule.

- Every private company referred to in sub-rule (2) making any offer for issue of any securities or buyback of securities or issue of bonus shares or rights offer, after the date when it is required to comply with this rule, shall ensure that before making such offer, entire holding of securities of its promoters, directors, key managerial personnel has been dematerialized in accordance with the provisions of the Depositories Act, 1996 (22 of 1996) and regulations made thereunder.

Please double click on the below attached official notification of MCA to open

Process of ISIN Generation of The Company and Conversion of Shares into Demat Form

ISIN Generation in India

- Appointment of RTA as Registrar & Share Transfer Agent

- Preparation of Tripartite Agreement among Issuer Company Registrar & Share Transfer Agent (RTA) Depository (NSDL/CDSL)

- Preparation of documents for application to the Depository (NSDL/CDSL).

- Board Resolution.

- NSDL Portal Creation Document.

- RTA Registration Form.

- Networth Certificate of the Company duly certified by the practicing CA.

- PAN ,COI, MOA & AOA of the company

- Latest Balance sheet set & Audit report of the Company (Not Required for Newly registered Company (ies))

- Email ID, Contact Number and Name of Director to be authorised.

- Submission of documents to Depository for review.

- Fees Payment to Depository and RTA during approval process.

- After approval and payment, the Depository will issue the ISIN.

- After obtaining ISIN, the shareholder needs to open his/ her demat account with any DP (check whether the company has obtained ISIN with NSDL or CDSL and open the demat account in same Depository):

The first step is to open a demat account with a DP. A DP is an intermediary between you and the depositor. The DP is necessarily registered with SEBI. You could open a demat account even with your bank which can also function as a DP. Ensure that the names in the demat account and the physical share certificates match.

- Fill Out Request Form:

Fill out a dematerialization request form once your demat account is opened. Take your physical shares with you and surrender them to your DP while filling out the form. Do not forget to write ‘Surrendered for dematerialization’ on every share certificate. - Submit Documents:

Once you submit all the documents, your DP will send a message electronically to the Registrar and Transfer (R&T) agent. The R&T agents have been entrusted with the job of maintaining your records. - Validity Check:

The T&R agent will run a check on the authenticity of the documents you have submitted. - Name Change:

The process to replace your name with your DP’s name begins now. Also, the number of shares getting dematerialized will be recorded in the Register of Members’ account. The Register of Members is the repository which stores the details of the shareholders. - Acknowledgement:

Once this process is completed, an acknowledgement is generated from the Register of Members saying the requisite changes have been made. The number will be forwarded to your DP. - Shares Credited:

Your dematerialized shares get credited to the demat account.

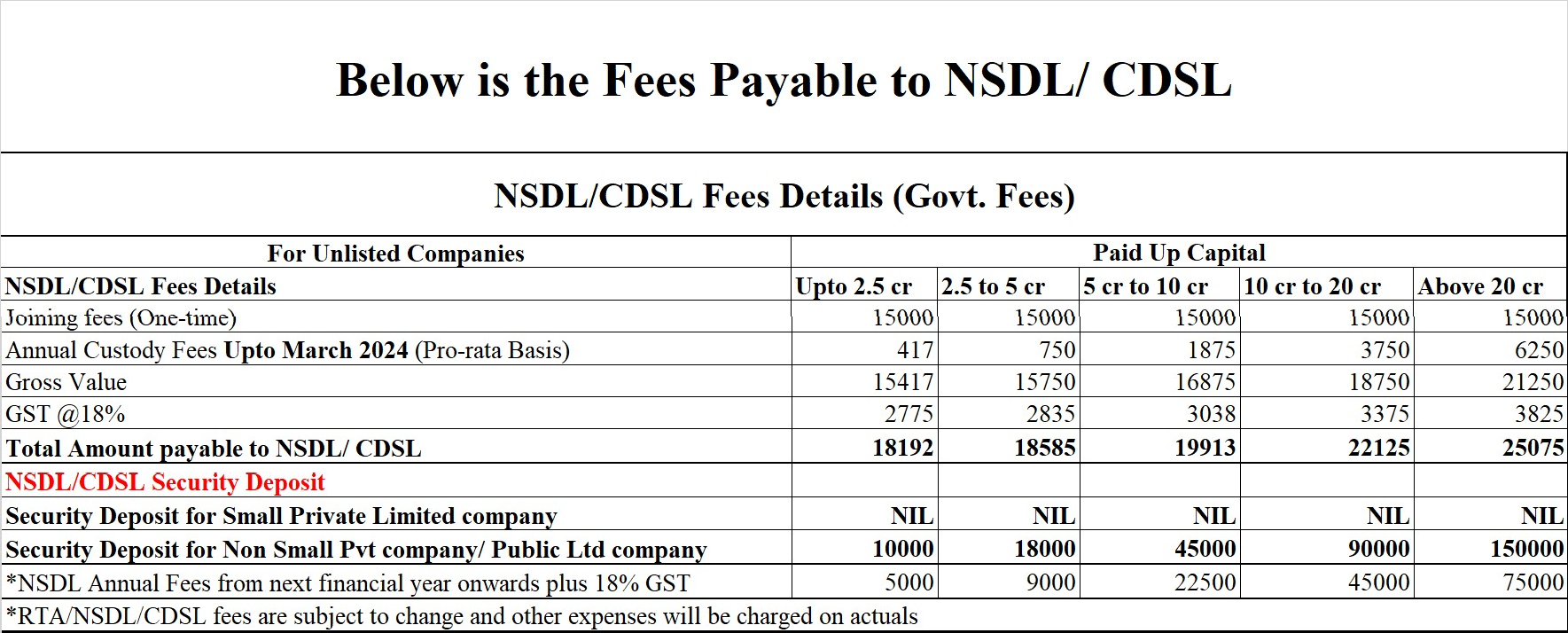

NSDL/CDSL Fees Details for Companies obtaining ISIN for DEMAT Registration (UNLISTED COMPANIES)

Note: The RTA Fee will vary according to RTA, but the standard fee will be around Rs. 10,000 to Rs. 15,000

RTA outsourcing services in India and international markets

Neeraj Bhagat & Co. provides comprehensive RTA services in India, offering outsourcing solutions tailored to your needs. Our expertise spans RTA services for IPOs and international markets, ensuring seamless compliance and efficient management. Whether you're navigating domestic or global markets, trust us for reliable RTA solutions that drive success.

Securities Digitization in India

Securities digitization in India marks a transformative shift in the financial landscape, revolutionizing the way securities are issued, traded, and managed. As a leading player in this arena, Neeraj Bhagat & Co. offers cutting-edge solutions to facilitate seamless digitization of securities. Our expertise encompasses a wide range of services, including digital issuance platforms, blockchain integration, and regulatory compliance. With our tailored solutions, businesses can harness the power of technology to streamline processes, enhance transparency, and unlock new opportunities in the digital economy. Trust Neeraj Bhagat & Co. to navigate the complexities of securities digitization and drive your success in the digital age.