GUJARAT GIFT CITY

Gujarat IT/ ITeS Policy 2022-2027

Gujarat IT/ITeS policy 2022-2027 was unveiled to promote the Information Technology Industry and to attract entrepreneurs to set up units in Gujarat.

The Policy is effective from 7th February 2022 and will remain in force till 31st March 2027 or till the declaration of a new or revised Policy. Only eligible entities who have applied for assistance on or before 31st March 2027 and who have commenced operation on or before 31st March 2028 will be eligible for incentives being provided through the Policy.

Eligible IT/ITeS Unit

- Any IT/ITeS unit, which is setting up its operations in Gujarat during the operative period of this policy with at least 10 employees on its payroll.

- An existing IT/ITeS unit in Gujarat undertaking expansion having minimum 15 employees on its payroll will be eligible for availing incentives under this policy after expansion*.

(*Expansion Unit means an existing unit in Gujarat undertaking expansion such that the headcount of employees on its payroll increase- by 50 per cent of the existing or

- by 1,000 employees,

New Unit shall mean

- IT/ ITeS unit that has or had obtained registration under the Companies Act/ LLP Act/ Partnership/ Proprietorship and is setting up or commenced its commercial operations in Gujarat during the operative period of the Policy. And

- An existing unit outside Gujarat State carrying out new investment in IT/ ITeS industry at any location in Gujarat and commences commercial operation during the operative period of the Policy.

IT Enabled Services (ITeS) covered under the Policy

The ITeS means any service, which results from the use of any IT software over a system of IT products for realizing the value addition service rendering through the application of IT. The services covered are :-

- Call centers

- Medical transcription

- Back Office Operation/ Business Process Outsourcing (BPO)

- Knowledge Process Outsourcing (KPO)

- Revenue Accounting and other ancillary operations

- Insurance claim Processing

- Web/Digital Content Development/ ERP / Software and Application Development

- Financial and Accounting Processing

- HR & Payroll Processing

- Bio-informatics

- GIS – Enabled services

- IT support centers

- Website services and

- Emerging Technologies such as Cyber security, Big data, Artificial Intelligence, Block Chain, Machine Learning etc.

Benefits given to IT/ITeS Units

The fiscal incentives being provided under the Policy shall be termed as the CAPEX-OPEX Model (Capital Expenditure – Operating Expenditure Model) Incentives which further vary on the basis of investment category.

Investment Category are of two types.

- Gross Fixed Capital Investment (GFCI): It means any expenditure on Fixed Asset excluding cost of land and expenditure or purchase of building.

{*expenditure incurred under GFCI towards the construction of new buildings shall be capped at INR 3,000/sq. ft. of built-up area (applicable for a total built-up area computed at 60 sq. ft. of built-up area per employee on the payroll of the eligible IT/ ITeS unit)} - Mega Project: Mega project means an Investment in the field of IT/ ITeS

- with a minimum GFCI of INR 250 crores or

- generating a minimum of 2,000 direct IT employment positions on its payroll in the state.

Eligible CAPEX Expenditure are

- Gross Fixed Capital Investment (GFCI) made during the operative period of the Policy and up till two years after the date of commencement of commercial operations/ production.

- Stamp duty and registration fees paid to the government for lease/ sale/ transfer of land and office space.

- Expenditure incurred on the purchase of equipment for setting up of captive renewable energy plant.

Eligible OPEX Expenditure include

- Lease rental expenditure

- Band with expenditure

- Cloud rental expenditure

- Power tariff expenditure and

- Patent expenditure

The benefits being given to IT/ITeS units under this policy can be summarized as follows.

For Gross Fixed Capital Investment(GFCI) less than INR 250 Cr.

-

CAPEX Support

- Amount: One-time CAPEX support of up to 25 per cent of the eligible CAPEX expenditure, subject to maximum ceiling of INR 50 cr. and

- Disbursement method: The disbursement will be done in twenty equal quarterly installments.

-

OPEX Support

- Amount: OPEX support of up to 15 per cent of the annual eligible OPEX expenditure, subject to maximum ceiling of INR 20 cr. per year for a period of five years and

- Disbursement Method: The disbursement will be done in quarterly installments.

GET IN TOUCH WITH US

Always ready to help you out regarding all your queries.

For Mega Project

-

CAPEX Support

- Amount: One-time CAPEX support of up to 25 per cent of the eligible CAPEX expenditure, subject to maximum ceiling of INR 200 cr. and

- Disbursement method: The disbursement will be done in twenty equal quarterly installments.

-

OPEX Support

- Amount: OPEX support of up to 15 per cent of the annual eligible OPEX expenditure, subject to maximum ceiling of INR 40 cr. per year for a period of five years and

- Disbursement Method: The disbursement will be done in quarterly installments.

Special incentives

There are some special incentives provided under the Policy for IT/ ITeS Units which are as follows:-

-

Employment Generation Incentive (‘EGI’): One-time support for every new local employees hired and retained for a minimum period of one year at 50 per cent of one month’s CTC up to

- INR 50,000 per male and

- INR 60,000 per female employee.

- Interest Incentive: Interest subsidy at 7 per cent on term loan or the actual interest paid, whichever is lower with a ceiling of INR 1 cr. per annum.

-

Atmanirbhar Gujarat Rojgar Sahay:

Reimbursement of the employer’s statutory contribution under Employees’ Provident Fund will be provided for a period of five years made upto:- 100% reimbursement in case of female employee;

- 75% reimbursement in case of male employee;

- There will be a per employee ceiling of 12% of the Basic salary + Dearness Allowance + Retaining Allowance.

- In case of expansion unit, this assistance will be available for incremental employee count beyond that existed before undertaking expansion.

- Electricity Duty Incentive (‘EDI’): Electricity duty upto 5 years will be borne by government of Gujarat for Eligible Units.

Incentive for IT City/Township

The incentives that are provided by the Policy for the IT City/ Township are

All eligible applicants are entitled to one-time CAPEX support of up to 25% of the eligible CAPEX expenditure, subject to a maximum ceiling of INR 100 cr. and the disbursement will be done in 20 equal quarterly installments

Monthly rental support under Co-working Space Model

Monthly Rental support is being given to eligible IT/ITeS Units opting to start their operations under Government facilitated/empanelment Co-working space model for a period of :-

- 5 Years from the date of start of commercial operations or

- 5 Years from the date of start of in-principle approval whichever is later

Rental Support amount

- For first 2 years of 50% of monthly rental per seat upto INR 10,000 per seat per month

- From 3rd year upto 5th year of 25% monthly rental per seat upto INR 5,000 per seat per monh.

Incentive for enabling cloud eco-system

-

Support for Cloud Ecosystem

- CAPEX Support:

- Amount: One time support up to 25 % of the eligible CAPEX expenditure subject to maximum ceiling of INR 20 cr. and

- Disbursement Method: The disbursement will be done in 20 equal installments

- OPEX Support: Power Tariff subsidy of INR 1/unit for period of 5 Years.

- CAPEX Support:

-

Support for Data Centers

- CAPEX Support:

- Amount: One time support up to 25 % of the eligible CAPEX expenditure subject to maximum ceiling of INR 150 cr. And

- Disbursement Amount: The disbursement will be done in 20 equal installments

- OPEX Support: Power Tariff subsidy of INR 1/unit for period of 5 Years.

- CAPEX Support:

Support to R&D Institutes/ Centers

R&D institutes/ R&D Centers established by educational institutes recognized by All India Council for Technical Education (AICTE) can avail one-time CAPEX support provided that the institute is acknowledged by Council of Scientific & Industrial Research/ Department of Scientific and Industrial Research for conducting research into the desired field.

Capex support will be provided for the purchase of equipment for setting up of R&D Center/ laboratory at 60% of the cost for machinery and equipment, hardware and software subject to maximum of INR 5 cr.

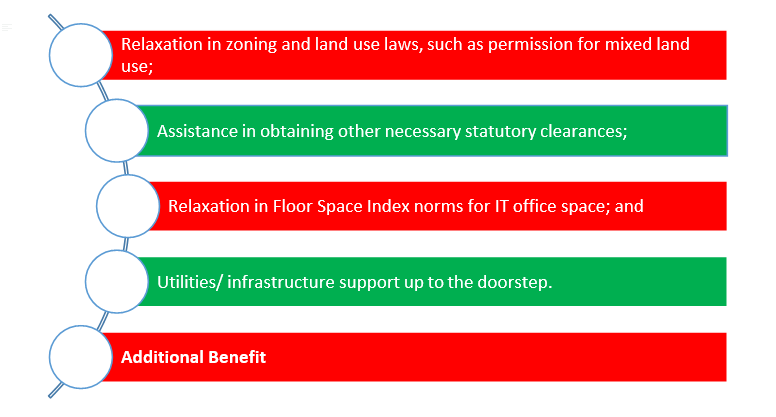

Various Non-fiscal benefits

- The government will duly facilitate the allotment of land for eligible projects subject to availability and fulfillment of eligibility criteria

- IT/ ITeS units will be allowed self-certification without the inspections under act, such as Factory Act, Maternity Act, Minimum Wages Act, etc.

- A common platform will be created to link all types of industries and a centralized helpdesk call center on a 24x7 basis will be developed.

Approaches by Government for Skill Development

-

Tier I Approach

Gujarat AI School or AI Center of Excellence (Advanced Center of learning): The Government envisions establishing an advanced center of learning with the objective to become the foremost source of industry-ready skilled talent.

-

Tier II Approach

Upskilling industry-ready talent Direct Benefit Transfer to graduate students and working professionals for successfully completing globally recognised courses in Information and Communication Technology

- up to a maximum of INR 50,000 per course or

- up to 50 per cent of the course fee

-

Tier-III Approach

Nurturing roots by promoting IT The government will launch programs targeting school students and general public aimed towards improving digital literacy,

- enhancing awareness of the potential of IT in daily life and

- building a foundation for the availability of skilled IT resources in the state.